- Perspective – March 2025

- Market Intelligence

- State of the Stainless Nation

- Sassda News – Push to boost Local Stainless Steel

- NDE Advert

- Sassda News – Inaugural Root Cause Analysis Conference Africa 2025

- Professional Profile : Bradley Klassen

- Technical FAQ

- Fastenright Advert

- Member News

- Project with Potentials – South Africa

- Project with Potentials – Nambia

- Focus Feature

- Member News – Enhanced Training Programme

- Sassda News – Eastern Cape Golf Day

SOUTH AFRICA’S MANUFACTURING CROSSROADS: A PATH TO REVIVAL

South Africa’s stainless steel and manufacturing industries face a pivotal moment. The potential closure of ArcelorMittal South Africa’s (AMSA) long-products division is a major challenge, with the risk of job losses and further de-industrialisation. However, this crisis also presents an opportunity for renewal and strategic action. In fact with the right interventions, South Africa can turn the tide, reclaim its industrial strength, and secure a sustainable future for its workforce. This column from Sassda Executive Director, Michel Basson explores the challenges, the impact of AMSA’s potential closure, and the urgent steps needed to revitalise the sector...

One of the most pressing concerns for the steel sector in South Africa is the potential closure of ArcelorMittal South frica’s long-products division, which could lead to the loss of up to 100 000 jobs. The shutdown of this major steel producer would not only impact direct employees but also disrupt supply chains and industries reliant on specialised steel products. Without immediate intervention, the consequences for South Africa’s industrial landscape could be devastating. In essence this is an example of de-industrialisation.

De-industrialisation refers to the process of migrating an economy from being manufacturing-based economy to a service-based economy. This normally involves a decline in the importance, wellbeing and contribution of the manufacturing sector to the overall economy, often accompanied by a growth in the service sector.

Amongst some there is still doubt that this process is taking place in South Africa. In broad terms de-industrialisation shows the following characteristics:

1. Decline of Manufacturing Employment: This is indicated by a decrease in the number of jobs in the manufacturing sector. Any South African, if asked, would agree that this is true in the country.

2. Shift to Service-Based Economy: An increase in the proportion of jobs and economic output in the service sector. This seems like the logical result of disappearing jobs in the manufacturing sector and this shift is also measurable in South Africa.

3. Closure of Industrial Facilities: The shutdown or relocation of manufacturing plants and facilities. In the case of AMSA, this is exactly what is taking place and has started a number of years ago with the “mothballing” of the Saldanha plant.

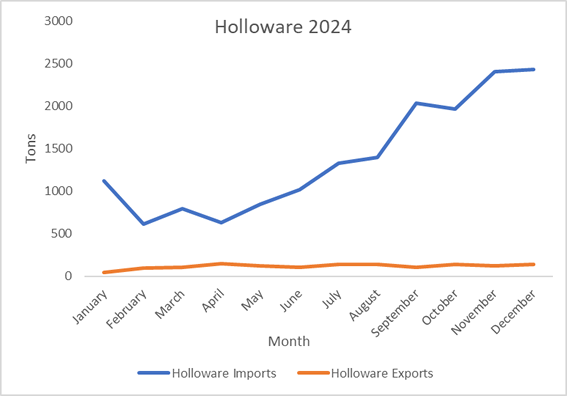

4. Loss of Industrial Capacity: A reduction in the ability to produce goods domestically. Many of our white goods were previously manufactured within the country but this position has reversed over the last two decades and is also illustrated very well by the lack of stainless steel finished goods still made in South Africa. Twenty years ago, South Africa still had the ability and capacity to manufacture more than 80% of local demand. This is no longer the case with the hollowware industry teetering on the edge of ruin for many years. The loss of capacity also implies the loss of skills. These skilled people now emigrate and become the competitor of our own industry.

The origins of de-industrialisation

The usual causes of de-industrialisation would be issues such as globalisation where products are now procured from countries with more competitive strategies. This would be acceptable since honest competition can make one’s own industry stronger and more competitive. However, local producers in South Africa need to contend with policies that include dumping and other unethical trade mechanisms.

Another reason for de-industrialisation could be technology which might give competitors an edge. It is sad to realise that investment in upgrading local technology to a competitive level will be slow and reluctant (even for local financiers) due to low levels of economic growth, crime and legislative and structural issues. In the world of stainless steel, we do not see that consumer trends influence stainless steel demand. The product is used for specific reasons that only stainless steel can satisfy. However, government policies still do not stimulate and encourage domestic manufacturing. This is clear from government’s inability to solve the de-industrialisation issue, with AMSA being the immediate casualty of regulatory and policy failures at many levels.

A looming crisis or a chance for renewal?

The outcomes of de-industrialisation for the South African economy are already painfully visible when we look at the levels of unemployment and financial inequality in society. The closure of AMSA will have a strong economic impact in a region that cannot afford it. Another example is how South African international policies are now threatening future participation in AGOA. This would be a total calamity for the auto industry and industries such as mining and agriculture. The South African economy and consumers will be forced to rely more heavily on imports.

The battle to revive domestic manufacturing

To mitigate these effects, industry stakeholders have been calling for a well considered and all encompassing metals sector industrial policy. In 2018 the Steel Master Plan was devised to address these issues as a strategy to promote local production, increase demand, and encourage investment in the stainless steel industry.

Unfortunately, this initiative, albeit strongly supported and driven by the private sector, is currently suffering from a severe lack of forward momentum. In light of this, some of the industry-related, private sector partners are forging ahead with some good initiatives, not willing to wait longer for direction from government and the relevant ministers.

The industrial partnerships and cooperation between private sector entities contributes vastly to the electricity supply issues of the past few years. Sassda believes that the same can be attained in the stainless steel sector when we surround ourselves with likeminded peer organisations with a will and positive attitude to make things work in South Africa. This attitude seems to be working, since the local consumption of stainless steel that was locally converted and added value to, has grown substantially with 53% in 2024 after a 16% decline in 2023.

This is slowly putting the local stainless steel industry on a path of recovery after more than a decade of steady decline. This is especially noteworthy since local production is still under constraints due to capped exports to the EU. Some of the import/export statistics for 2024 illustrates some of the areas that can be developed for local manufacturing. Not only finished goods, but semi-finished goods and products that can be seen as secondary product such as tube, pipe and other long products.

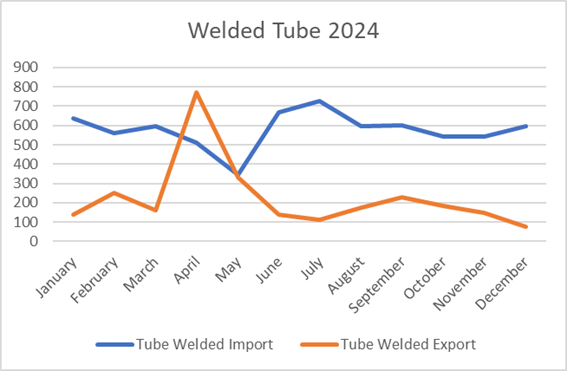

Most of the welded tube made in South Africa is utilised in application such as the auto-industry, food processing and structural. The export of tube is mainly by the auto-industry in the form of exhaust components and the like. The South African auto industry is highly competitive and makes use of modern technology. However, it still cannot compete against the imported product due to pricing issues. Given a level playing field, these local producers could be competitive with other global competitors. Unfortunately, the playing field is not level at all. When the pricing of imported product is analysed, it becomes clear that the local producers compete against subsidised product from abroad. This trend has been reported to dtic, including ITAC. Unfortunately, there seems to be an atmosphere of general reluctance to address these critical issues for a major foreign currency generator in our industry, and the problem gets kicked around with no solution in sight.

Getting a handle on knives and forks

A similar scenario is playing out in the holloware sector. Holloware includes products such as cookware, pots, pans and other cooking utensils. As mentioned earlier, South Africa had the capacity and technology twenty years ago to be not only a market leader and exporter of these items but had the ability to supply more than 80% of local demand. This is an industry in which around three to five jobs per ton can be created in the value chain thus a critical sector for job creation for skilled and semi-skilled employment. More than 16 000 tons were imported during 2024 compared to 1417 tons being exported. Once again the few local suppliers able to service the market have to compete on another slanted playing surface against products that use substandard material, that do not comply with SABS standards, and in many cases also clearly subsidised in some form or another.

Seizing the opportunity for growth

On the positive side, Sassda has been working with Columbus Stainless and other industry partners to link major retailers with South African producers. The revival of this industry will not take place overnight, but will rather be a slow process focussed on limited items which will allow local producers gain experience and capacity to tackle the broader market. However, it remains outside the Sassda’s domain or that of private industry to administrate and initiate regulations to level the playing fields. In the face of this, the need for a sharper focus on import tariffs has never been more important. However, the decision ultimately lies with the government, but unfortunately there has been little movement on the issue. This uncertainty has made it difficult for manufacturers to plan for the future, further hindering growth in the sector.

The sector needs to be positive and proactive and as part of this drive Sassda is trying to create new potential markets for local stainless steel. Innovation in the South African stainless steel industry has been in existence since the early years when one of the most notable achievements in the global industry was developed namely 3CR12. This stainless steel grade was pioneered by the local mill, Columbus Stainless as far back as the 1980s. This material is currently used in various industries, including rail, transport, and construction. The full potential of this cost-effective replacement for coated steel products has not been fully developed and rectifying this will be a Sassda key focus during 2025.