- Perspective – November 2020

- State of the Nation

- Sassda Newsflash

- GPS World of Fame

- Sector Focus : Oil & Gas

- Global Insight

- Case Study

- Advertorial : Unique Welding

- Sector Focus : Holloware

- Advertorial : ‘No Flash in the Pan’

- Business Strategy

- Advertorial : Valbruna Stainless South Africa

- Maximizing the Cost-Effectiveness of Stainless Steel

- Technical Insights

- The importance of making the Correct Tool Choice

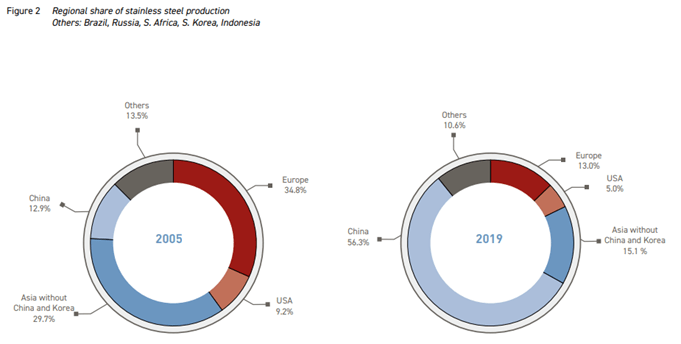

THE CHINA SYNDROME

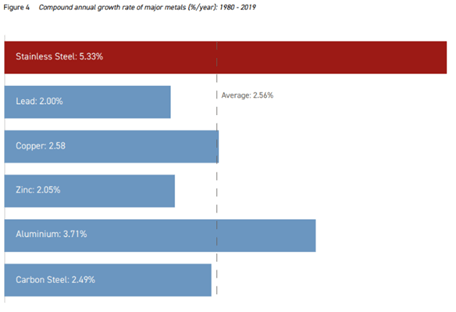

In the past two decades China has conquered the global stainless steel market. Stainless steel is vital to virtually every other sector, and production is growing faster than that of other metals such as lead, copper, and aluminum.

However, whenever a discussion of local conditions takes place, there is some debate over the unfair trade practices in China which are having a negative impact on local manufacturers. There is a constant argument that Chinese trade practices are sometimes in contravention of World Trade Rules. However, in some cases they are generally accepted and hence competitor countries need to find a balance in the way they trade with China.

When speaking to our members on this issue, most do not expect government to render unfair support to expand business or be more competitive. Most members have confidence in their ability to be globally competitive if competing on normal business principles.

According to WTO rules countries cannot develop country specific tariffs. Member companies are encouraged to supply Sassda with any evidence or suspicions of unfair trade practices such as dumping or unfair subsidies. Sassda will conduct background research and escalate the matter to ITAC via dtic if there is merit in the complaint. It is therefore the role and responsibility of individual member companies to bring to our attention, and thus the attention of government where they find or suspect unfair trade practices.

A realistic assessment

The Chinese steel industry is (as is most of the Chinese economy) complex and is largely government owned. Therefore, many products are often not priced in the same way as products from competitive traditional capitalist factories. This is considered non-competitive according to WTO definitions.

By this time, we are all aware of the subsidies and advantages Chinese manufacturers receive in the form of land, equipment, material, energy, transport and even export value add. On the other hand, it is also known that labour in China is on average more productive than in other countries based on their six day work week and limited public holidays. The number of hours spent at work is therefore much higher for most working Chinese, when compared to other countries. Hence, when comparing Chinese and South African wages, the cost structures are hard to measure and compare. According to various research studies the Chinese government is willing to subsidise a variety of products to gain market share. Value added steel products fall in this category and, in many cases, the product is sold at a rate below the true value.

It is becoming clear that Chinese manufacturers are not necessarily more cost competitive than local member companies when the comparison is based on efficiency or technological superiority but rather because of government support mechanisms.

In South Africa we do not necessarily want a portion of the Chinese market, but in a battle for survival our local manufacturers only want to retain their current market. This does not mean your manufacturing business cannot compete on a global level. Here are some tips on how to compete against offshore manufacturers, even as a small business.

- Do not Try to Compete on Price - Differentiate your product rather on quality, service, and value for money.

- “Made in South Africa” - Many South Africans will be willing to pay a small premium for a local product due to their sold track record and current higher levels of trust and increased accessibility due to the COVID-19 pandemic and its effect on cross border trade.

- Focus on Quality - Customers are often willing to pay more for quality products that represent value for money. Be specific in your labeling and marketing around the quality aspects that set your products apart from the competition.

- Certification - Certifications indicate specific levels of quality, testing and performance. Customers tend to trust these third parties more than your own marketing claims. Overseas competition does not always conform to standardised norms. From a maintenance and life cycle costing view, this is important to first world markets.

- Community focus - “Buy South African” has become a popular sentiment. In the area where your business operates, get involved and provide an open and active presence in the community.

- Focus on Service - Creating a great customer experience through service excellence.