What is described as the largest project ever undertaken in Africa, the US$128-Billion Mozambique LNG Gas Project, which holds excellent potential for SA stainless steel supply, has shifted into first gear in the last month with the offshore portion of the project having been given the green light in early October (estimated completion 2025). This follows the final investment decision for the onshore portion of the project having been made in June 2019 (estimated completion 2024).

The timing of the development of Mozambique’s offshore gas reserves couldn’t be better with an increase in global LNG demand stemming from a landmark shift in China’s energy/power policy from coal to gas. As a result, many of its economic sectors are already showing increased demand for gas with the International Energy Agency describing China as “the emergent giant of gas demand”.

It is estimated the increase in global gas demand, will move from 319 metric tons/annum in 2018 to 632 metric tons/annum in 2040. One of the key benefits of the Mozambique project is that the gas it will supply will be of a very high quality and need less refining and will therefore be cheaper to produce than other areas of the world.

To keep our members fully informed on this massive project, Sassda recently attended an Africa House briefing where Development Director Roelof van Tonder described the project as a ‘game changer’. “There are immense opportunities for South African companies as local companies can benefit from the sheer volume of work already under way in our northern neighbour.”

He clarified; “There will be some local content regulations but as yet these have not been passed by the Mozambique government and this means there is a golden window of opportunity for South African companies to identify and partner with local Mozambique partners driven by the understanding that they need to collaborate to compete. Overall, the scale of these projects requires proper planning and a long-term strategic response from South African companies that need to position themselves to benefit from the numerous contracts that will arise.

Additional insight on the opportunities that abound for SA companies was provided in a recent Dailymaverick.co.za article where Standard Bank Head of Oil & Gas Paul Eardley-Taylor said; “A $128-billion capex spend over a decade is a major opportunity for South African business to physically supply the projects (and associated investments). SA could export goods and services to Mozambique and investors could form companies in partnership with Mozambique nationals. There will also be opportunities for SA human capital working on the LNG projects and other domestic gas investments as employees, contractors, manufacturers, service providers and consultants.”

Additional insight on the opportunities that abound for SA companies was provided in a recent Dailymaverick.co.za article where Standard Bank Head of Oil & Gas Paul Eardley-Taylor said; “A $128-billion capex spend over a decade is a major opportunity for South African business to physically supply the projects (and associated investments). SA could export goods and services to Mozambique and investors could form companies in partnership with Mozambique nationals. There will also be opportunities for SA human capital working on the LNG projects and other domestic gas investments as employees, contractors, manufacturers, service providers and consultants.”

Mozambique’s limited infrastructure to handle projects of this scale will also see new ports, roads, electricity and water infrastructure and the need to construct far more hospitals, schools and shopping centres.

Eardley-Taylor added that Standard Bank has committed to finance part of the Mozambique LNG Anadarko project (which has been acquired by French petrochemical giant Total) and also plans to finance part of the ExxonMobil project due to be announced later in 2019. “This could then see South Africa’s Export Credit Insurance Corporation, a dti subsidiary, underwriting part of this investment which could secure market access for SA companies of over $500-million. And the same could apply if SA companies are involved in Rovuma LNG.”

The list of projects that fall under the overall Mozambique Gas development include:

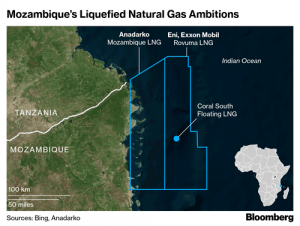

- Coral Floating Liquid Natural Gas (LNG) Project – The world’s first ultra-deep-water FLNG facility US$9-Billion that is expected to produce its first gas in 2022

- Mozambique LNG on and offshore (FYI – Total completed the acquisition of Anadarko’s 26.5% stake in this project at the end of September 2019) this will see the development of integrated offshore and onshore gas fields in the Rovuma basin, east of Palma to be fully commissioned by 2024 and will produce 12.9 MTPA. This is one of the largest greenfield LNG facilities to have ever been approved and involves building infrastructure to extract gas from a field offshore northern Mozambique, pump it onshore and liquefy it, ready for further export by LNG tankers. The impact of this project alone, on the economy of Mozambique, will be immense with a projected surge in the country’s current GDP from 2.7% in 2019 to 10.2% by 2024.

- Rovuma LNG on and offshore activities as described above – This project is led by ExxonMobil and ENI and will be fully commissioned 2025 and produce a whopping 15.2 MTPA. The Rovuma LNG project alone has the capacity to boost GDP by between $15-billion and $18-billion per annum and contribute $5-billion annually to the fiscus and create 323,000 employment opportunities.

- Unitised ‘Trains’ – By 2024 Mozambique should have four onshore LNG Trains operational and 1 FLNG ship, with an additional four onshore LNG trains expected to be operational by 2029/30 – this will trigger a second wave of Domgas projects.

FYI – An LNG train is a liquefied natural gas plant’s liquefaction and purification facility. For practical and commercially viable transport of natural gas from one country to another, its volume has to be greatly reduced. To do this, the gas must be liquefied by refrigeration to less than -161 °C

- Domgas Projects – Gas to Liquids, Fertiliser, Independent Power Projects, LNG Bunkering, small scale LNG, Methanol to olefins

To find out more e-mail lesley@sassda.co.za and visit the following websites for additional reading:

- https://www.reuters.com/article/us-mozambique-anadarko-lng/anadarko-approves-20-billion-lng-export-project-in-mozambique-idUSKCN1TJ2DI

- http://www.mzlng.com

- http://www.mzlng.com/Opportunities/Suppliers

- https://www.dailymaverick.co.za/article/2019-09-24-gas-in-mozambique-a-128bn-opportunity