- Perspective – July 2022

- Advert : Columbus Stainless

- Industry Analysis

- Advert & Advertorial – EMV Africa

- Member Benefits

- Member Innovation

- Market Intelligence

- Advert – Beyond Stainless Steel Workshop

- Professional Profile

- Advertorial – Innov-X-Africa

- Advert – Innov-X-Africa

- Market Analysis

- Technical Analysis

- Technical Insight

- Advert – Unique Welding

- Africa Market Intelligence

- Member Events

MOZAMBIQUE OIL AND GAS LOOKING FORWARD

Mozambique is the site of one of the largest oil & gas discoveries of the 21st Century. With stability now returning to the region in which these resources will be extracted, processed and distributed, Sassda Market Intelligence Specialist Lesley Squires provides an update on this vital market for Southern African stainless steel demand…

The Economy

Mozambique experienced modest GDP growth in 2021 of 2.2%, followed by a contraction of 1.2% in 2020, owing to COVID-19 restrictions, temporary operational issues at major mines, the destruction of infrastructure and property due to floods, and the displacement of communities because of ongoing insurgency in Cabo Delgardo.

Standard Bank Mozambique forecasts economic growth of 3.5% in 2022 fuelled by the external sector. Increased coal production at Moatize Mine and exports of other commodities, such as aluminium, should benefit from the short-term commodity shortages created by the Ukraine-Russia conflict and some price upsides.

Mozambique’s fiscal performance was better than expected in 2021 as revenue increased by almost 2%, while expenditure growth was contained to less than 1%. Inflation is expected to close at around 9% in 2022 due to higher fuel and food prices, exacerbated by the Russia-Ukraine conflict.

Political movements

President Nyusi replaced the prime minister, finance minister, and head of the country’s natural resources and energy portfolio in March, just weeks before the IMF announcement of a staff-level agreement for a $470-million Extended Credit Facility over three years.

President Nyusi replaced the prime minister, finance minister, and head of the country’s natural resources and energy portfolio in March, just weeks before the IMF announcement of a staff-level agreement for a $470-million Extended Credit Facility over three years.

The IMF’s support should boost the government’s ability to implement reforms amid elevated political risk stemming from the ongoing insurgency and repercussions of the 2016-17 debt crisis. The agreement with the IMF aims to promote inclusive economic growth but is also linked to the restoration of public finances, strengthening of governance, and improving transparency, particularly the management of the wealth derived from developing the LNG sector.

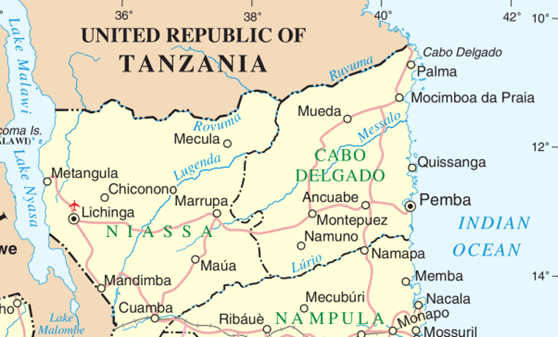

Carbo Delgardo Security update

The presence of Rwandan and SANDF military forces on the ground state that they intend to create a safe perimeter for work to resume. The safe perimeter would be a 50-kilometer exclusion zone away from

- Afungi

- Palma

- Mocimboa de praia

- Mueda

- Pundahar

- Macomia

- Chai.

Military actions have been carried out recently in Chai, Quitarejo and Mucojo by the Rwandan forces. A month-long, joint operation by Rwandan security forces and the SADC Mission in Mozambique in the Macomia district of Carbo Delgardo has restored life to normal.

The South African military announced that the SANDF deployments in Mozambique will be extended by a full year. The EU will send 200 to 300 military training officers to Mozambique in 2022 to train their forces. Portugal is to supply half the personnel and the commander for the two-year-long mission.

Oil and Gas update Northern Mozambique

Mozambique is expected to become a major LNG exporter due to the discovery of over 180 TCF (Trillion cubic feet) of natural gas reserves in the Rovuma basin in the north of the country.

Mozambique holds the third largest proven natural gas reserves in Africa (after Nigeria and Algeria) and could be among the world’s largest 10 exporters of LNG within a decade.

- Area 1

Area 1 covers approximately 2.6 million acres. Offshore Area 1 is located within the Rovuma Basin, approximately 40 km offshore of Northern Mozambique. This area is led by TotalEnergies with plans to build 6 LNG plants.The first two plants are about 13mtpa ($23b) and reached FID in 2019. TotalEnergies onshore project (MLNG) is under Force Majeure and resumption is dependent on an improvement of the security situation. - Area 4

Area 4 is led by ENI (all upstream operations) and ExxonMobil (construction and operations of LNG facilities onshore located in the Afungi LNG Park).ExxonMobil said that it would conduct an independent assessment of the security situation before taking the FID decision, which is not expected before the second half of 2023.An $8 billion FID for the construction of six subsea wells connected to an FLNG has been decided. The vessel is already in Mozambique with production planned for the second half of 2022.

Oil and Gas update Southern Mozambique

Sasol PSA/PPA Temane/Pande Sasol Petroleum Mozambique Limitada (SPM) is the Operator of the Production Sharing Agreement (PSA), which is a license holding in the Province of Inhambane, Mozambique. SPM has been actively executing the Field Development Plan (FDP) which describes SPM’s intent to optimally develop the light oil and gas resources contained in the Inhassoro, Temane and Pande fields.

Sasol PSA/PPA Temane/Pande Sasol Petroleum Mozambique Limitada (SPM) is the Operator of the Production Sharing Agreement (PSA), which is a license holding in the Province of Inhambane, Mozambique. SPM has been actively executing the Field Development Plan (FDP) which describes SPM’s intent to optimally develop the light oil and gas resources contained in the Inhassoro, Temane and Pande fields.

To enable the objectives contained in the revised FDP (now submitted for government approval), SPM requires the drilling of new PSA development wells and the construction of a new light oil, gas and LPG processing facility and associated surface facilities infrastructure in Temane, Inhambane (the PSA Project).

In support of the engineering, procurement and construction of the PSA Project, SPM will be required to procure from the market, various goods and services. All procurement processes to be followed by SPM will be required to follow PSA licence requirements, i.e., competitive tender through the Expression of Interest (EOI) process.

The EOI process entails advertising the contract requirements on public media namely Mozambican local newspaper The Noticias and the Sasol website, to solicit potential bidders. Upon receipt of response submissions to the EOI advertisement placed, a shortlist of qualified bidders is required to be prepared by SPM and submitted to the Instituto Nacional de Petroleo (INP) for approval before SPM issues Requests for Quotation to the market to select potential bidders with which to contract.

SPM will publish all requests for EOIs regarding the PSA Project that will also be published in the Noticias newspaper. The detail of what will be requested from interested parties will be contained in full within the actual request for the EOI document.

Beluluane Gas Company Project

Beluluane Gas Company SA (BGC) is a Mozambique registered company, which owns a concession for the import of LNG into the Matola harbour.

Beluluane Gas Company SA (BGC) is a Mozambique registered company, which owns a concession for the import of LNG into the Matola harbour.

The concession also gives BGC the right to construct all the required infrastructure in the Matola harbour to permanently moor an FSRU, receive LNG carriers for refilling the FSRU and the right to construct pipeline infrastructure to connect the FSRU with the Beluluane Industrial Park.

In the Beluluane Industrial Park, the BGC pipeline will connect with a new 2 000MW gas-fired power station being developed by Central Térmica de Beluluane (CTB). BGC is also developing a Truck Loading Facility (TLF) near the FSRU berthing location, to fill trucks with LNG to transport to markets in Southern Africa, which are not connected to the pipeline network.

Critical project milestones achieved:

- Concept studies completed in 2012

- Government engagement regarding Concession negotiations initiated in 2016

- EIA Fatal Flaw analysis completed in 2016

- Pre-FEED studies completed in 2018

- Concession awarded in 2019

- Onshore and Offshore FEED completed mid-2021