- Perspective – November 2024

- Member News – Laser Welding Workshop

- Member News – SARS & Sassda Training Session

- Market Intelligence

- State of the Stainless Steel Nation

- NDE Advertorial

- Spotlight Series Feature – Nocwaka Ntshangase

- Spotlight Series Feature – Confidence Lekoane

- Spotlight Series Feature – Fiona Jacobs

- Spotlight Series Feature – Tholwana Mogowane

- New Member Profile – Multi Business Division

- New Member Profile – Lumax Energy

- Professional Profile – Daniel Beukes

- Case Study – Stainless Steel Grade Selection

- Africa Market Intelligence – Uganda

- Member Benefits

- Member News – GSSE Expo

- Sassda News

Two Sides to the Stainless Steel Coin in 2024

2024 has been a year of contrasts for South Africa’s stainless steel sector with macroeconomic improvements like stable electricity and a stronger Rand tempered by sector- specific challenges. Despite these challenges Sassda Executive Director Michel Basson says the Association remains steadfast in its commitment to driving innovation and local growth...

1. How would you categorise 2024 for the South African stainless steel sector and what have been the key achievements and most pressing challenges?

There are two sides to the coin when reflecting on 2024. The year began with trepidation, mainly due to uncertainty surrounding electricity supply and the national elections. However, as the year progressed, uninterrupted electricity became a lasting reality. Additionally, the Rand strengthened after an election that demonstrated mature political behaviour, coupled with lower inflation and interest rates.

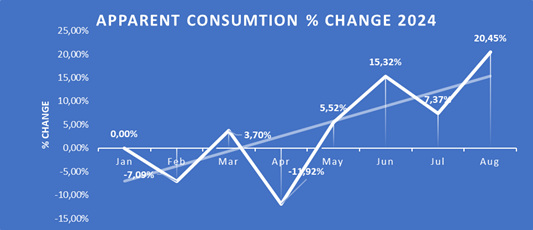

Despite these positive macroeconomic indicators, the stainless steel sector has not experienced a corresponding increase in activity. Apparent consumption of stainless steel contracted by 16% during 2023, as illustrated in the graph below, bringing an end to the growth phase that began in 2021.

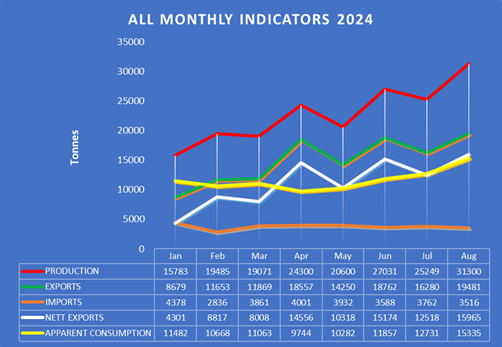

However, it is not all doom and gloom, as monthly indicators for 2024 suggest renewed activity in the local stainless steel sector.

For Sassda, the focus remains on growing local stainless steel consumption. Encouragingly, there are signs that local consumption may grow during 2024, potentially at a rate exceeding national GDP growth. While this would be a noteworthy achievement, it is unlikely to elevate the industry to a position significantly better than in 2018.

As has been emphasised before, the South African stainless steel industry is resilient and remains optimistic about the future, albeit with slow progress. Growth opportunities exist in renewable energy, electrical transmission, general infrastructure, and agriculture-sectors often highlighted in economic discussions. For now, we must take the bitter with the sweet, echoing Jan Smuts’s observation from 75 years ago: “Still, the worst, like the best, never happens in South Africa.”

2. Please outline Sassda’s discussions with the Department of Small Business Development Department to boost local sourcing of stainless steel cutlery and holloware?

Sassda has taken certain initiatives to a national level through its participation in the Steel Master Plan. To achieve tangible results, we have now engaged with the Department of Small Business Development (DSBD). Discussions with senior officials in the department revealed a shared vision for supply and value chain development, with initiatives and products available to support some of our members.

The majority of Sassda members are small and medium enterprises (SMEs), making SME growth a critical priority. Beyond serving members, SMEs represent a vital part of the stainless steel value chain, as this is where most jobs are created, and value is added.

One of these initiatives involves revitalising the South African hollowware and cutlery industry. Historically, this labour-intensive sector supplied over 80% of the local demand for these items. There is now an opportunity to localise or reclaim more than 10 000 tons of related finished stainless steel goods currently being imported annually.

Sassda, together with industry partners under the Steel Master Plan, has facilitated collaboration between a prominent local retailer and a fabricator in rural Eastern Cape. This partnership is yielding tangible results, with orders now being placed.

Given that production volumes are crucial for cost competitiveness in this sector, Sassda believes that collaboration with the DSBD will encourage more retailers to support local production. This effort will also increase government procurement of local products through departments such as Health, Defence, and Correctional Services.

3. Which specific roles or projects has Sassda taken on to encourage retailers to prioritise locally produced stainless steel products?

Sassda does not offer direct incentives to retailers to encourage local product purchases. Instead, it appeals to the patriotism and long-term vision of South African retailers, urging them to invest in real growth for the local industry. The argument is simple: by investing in local procurement, retailers contribute to skills development and job creation while supporting the South African communities that sustain their businesses through daily purchases.

Collaboration with the DSBD offers additional opportunities for smaller manufacturers. For example, the DSBD continues to offer powerful cluster development programmes that have been highly effective in advancing stainless steel industry sectors in the past.

These partnerships can help smaller entities access larger markets, enabling sustainable growth.

4. What are some key strategic initiatives Sassda has pursued recently and how are they shaping the South Africa’s stainless steel industry?

Sassda’s strategy, as outlined in the Steel Master Plan, remains focused on developing local demand as a foundation for eventual export-driven growth. This strategy emphasises two primary objectives:

- Increasing Local Tonnage Usage: Stimulating the bulk use of stainless steel in infrastructure projects such as electrical transmission, renewable energy, water supply, and rural bridges. Progress here depends on government rollout schedules.

- Job Creation Initiatives: Projects like the hollowware initiative aim to localise beer keg production, among others. Collectively, these initiatives have the potential to create over 30,000 sustainable jobs-a critical focus in the current socio-economic environment.

Sassda is also exploring opportunities to replace traditional materials like wood and galvanised steel with alternatives such as 3CR12. In 2025, Sassda plans to actively promote 3CR12 as a cost-effective substitute for applications like roofing, cladding, storage, and lightweight construction.

5. What do you see as the biggest threats facing South Africa’s stainless steel industry today?

The performance of the South African stainless steel industry is closely tied to the broader national and global economies. While the sector performs reasonably well under challenging circumstances, it is far from reaching full capacity.

Potential threats include sub-standard imports, dumping, and exchange rate fluctuations. However, the greatest danger lies in complacency. After years of lateral growth, there is a risk of accepting the status quo and neglecting opportunities for innovation and adaptation.

For example, technological advancements such as laser welding and the broader applications of stainless steel are often underutilised. A lack of knowledge and unwillingness to adapt to change can hinder progress.

To counter these threats, the industry must cultivate passion, innovation, and a deeper understanding of the material to thrive in this challenging environment.

6. Where do you see the greatest opportunities for innovation and growth in the local stainless steel industry?

Opportunities in the stainless steel industry often emerge through innovative problem-solving and a comprehensive understanding of the material’s diverse properties. With over 200 stainless steel grades developed for specific applications, the potential for innovation is immense.

While stainless steel is widely regarded as a solution for corrosion issues, its physical and mechanical properties offer much more. For example:

- Some grades are magnetic, while others are not.

- Certain grades work-harden, while others do not.

- Some grades offer excellent thermal conductivity, while others do not.

True opportunities arise when these properties are creatively applied to solve real-world challenges. Sassda fosters a culture of innovation by promoting knowledge, encouraging problem-solving, and supporting projects that demonstrate stainless steel’s versatility. By leveraging the material’s potential, the industry can achieve greater efficiency and long term sustainability.