- Perspective – July 2021

- Advert : Columbus Stainless

- Industry Insights & Analysis

- Market Intelligence

- Demand Sector

- Advert : NDE

- Market Insight

- Case Study – A Guide to Life Cycle Costing Analysis

- Industry News

- Africa Market Intelligence – Botswana

- Africa Market Intelligence – Nambia

- Profile Passionate Professionals

- Training Overview

- Advertorial : Columbus Stainless Champions Safety Week

- Advertorial : Macsteel Business Transformation focus delivers Independent Ownership

- Obituary

- Advert : Malondi Capital Investments

State of the Nation

In our Perspective article in this issue, we refer to a seemingly growing demand for stainless steel of all forms at a global level. We also mentioned maintained levels of high confidence in the local stainless steel sector. In this article we will support these statements with some graphic statistics. The statistics were supplied by the ISSF as well as from our own research based on data received from dtic, SARS and SeifSA.

The historic growth rate of global stainless steel consumption is historically at a compounded rate of 5.8%. This rate has been measured for over a 100

The historic growth rate of global stainless steel consumption is historically at a compounded rate of 5.8%. This rate has been measured for over a 100

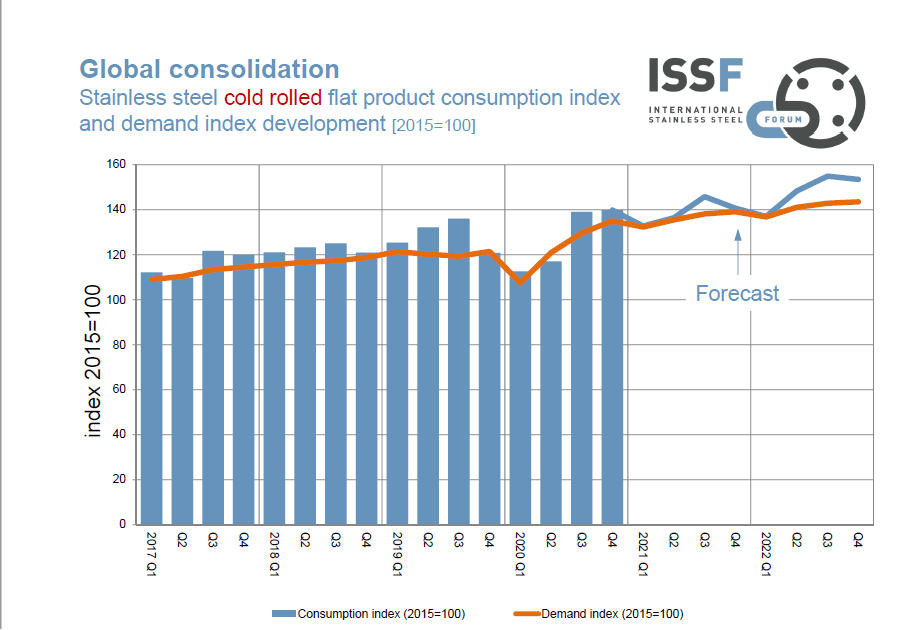

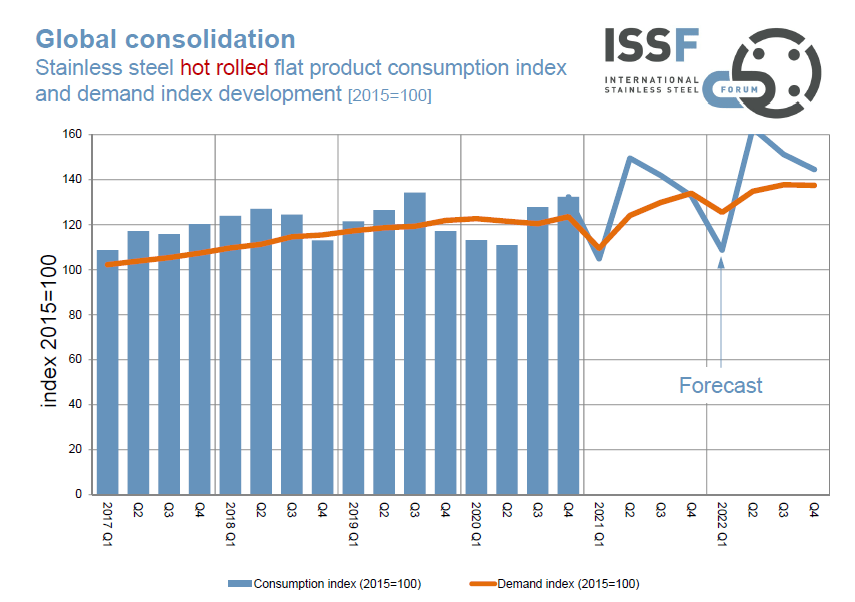

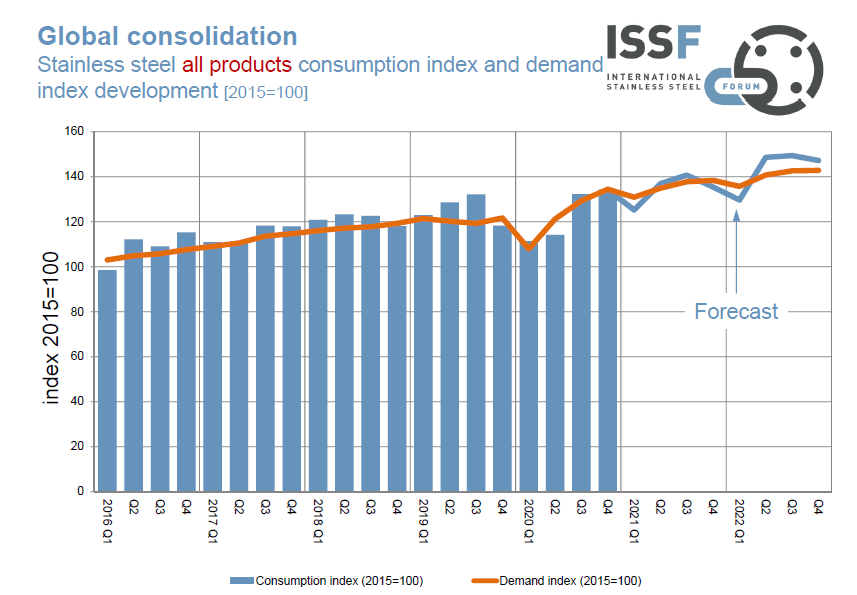

years and takes into account all the global calameties over the past century. We are still amids such a crisis period and it is therefore interesting to note that the ISSF forecast for cold-rolled flat products remain stable at around the 140 mark. Given the COVID-19 pandemic and its influence on production and demand in the first quarter of 2020, it shows some resiliency in the market. However, the hot-rolled global forecast

indicates large fluctuations. Long products seem to show a similar trend as cold-rolled products. As a result, the forecast for all products is one of growth - with the impact of the hot-rolled fluctuations visible.

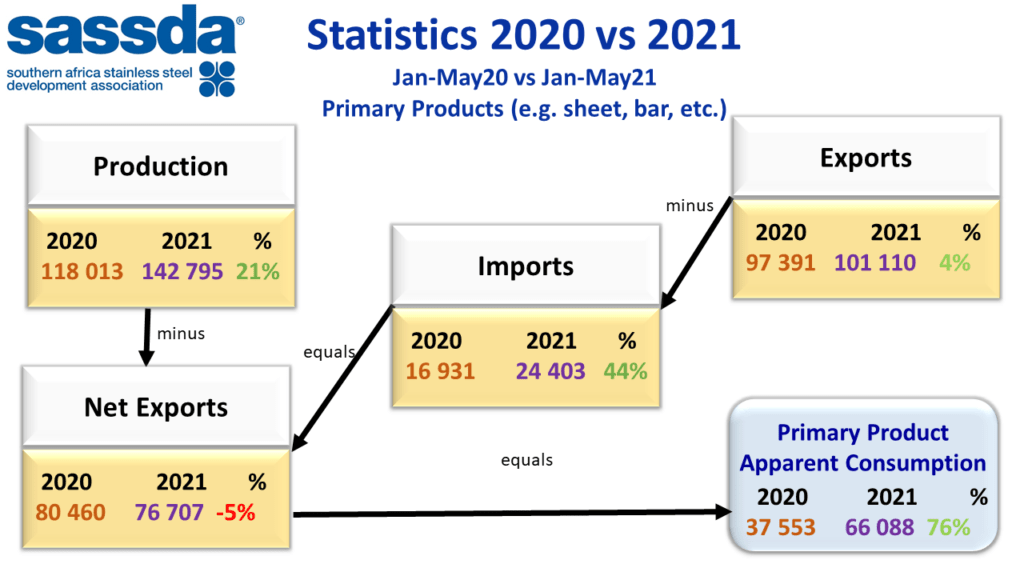

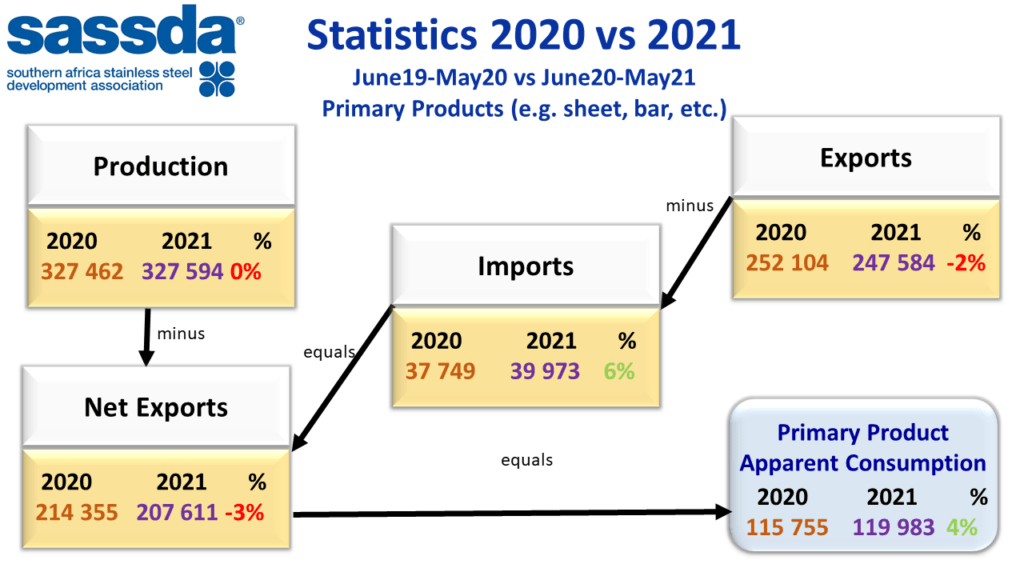

Should we bring our view closer to home, the figures for apparent local consumption of stainless steel are shown in the infographic above. The three-month annual comparison, as shown on the left, indicates at 21% increase in production but this must be seen within the context of production having been halted for a period during the early parts of 2020.

The year to year comparison shows a more realistic picture of the impact on local consumption caused by the lockdown restrictions and other COVID-19 related factors during the early part of 2020. All indications are pointing to growth in consumption this year. The question remains whether this will bring industry back to levels seen in pre-pandemic times. It remains possible.

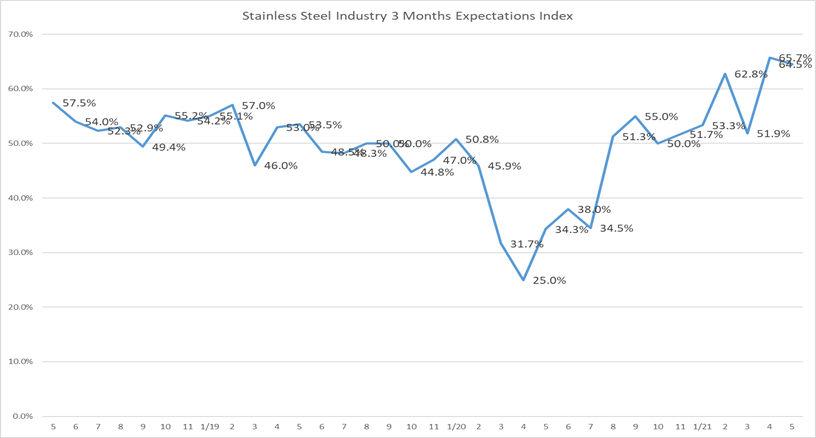

The graph above brings us even closer to home. This is statistics from our monthly Short Track Survey amongst members and key stakeholders in the industry. The confidence levels of Sassda members have sharply increased, from the low (25%) levels recorded a year ago to around 60% for the last three months. Reports are being received of a growing workload in certain sectors of membership.

We would like to be adding to this positive momentum by predicting continued high levels of membership confidence and Sassda would be doing its best to provide opportunities for assistance, learning, and marketing as the most active stainless steel association globally.