- Perspective – November 2020

- State of the Nation

- Sassda Newsflash

- GPS World of Fame

- Sector Focus : Oil & Gas

- Global Insight

- Case Study

- Advertorial : Unique Welding

- Sector Focus : Holloware

- Advertorial : ‘No Flash in the Pan’

- Business Strategy

- Advertorial : Valbruna Stainless South Africa

- Maximizing the Cost-Effectiveness of Stainless Steel

- Technical Insights

- The importance of making the Correct Tool Choice

Global & Local Stats and Analysis

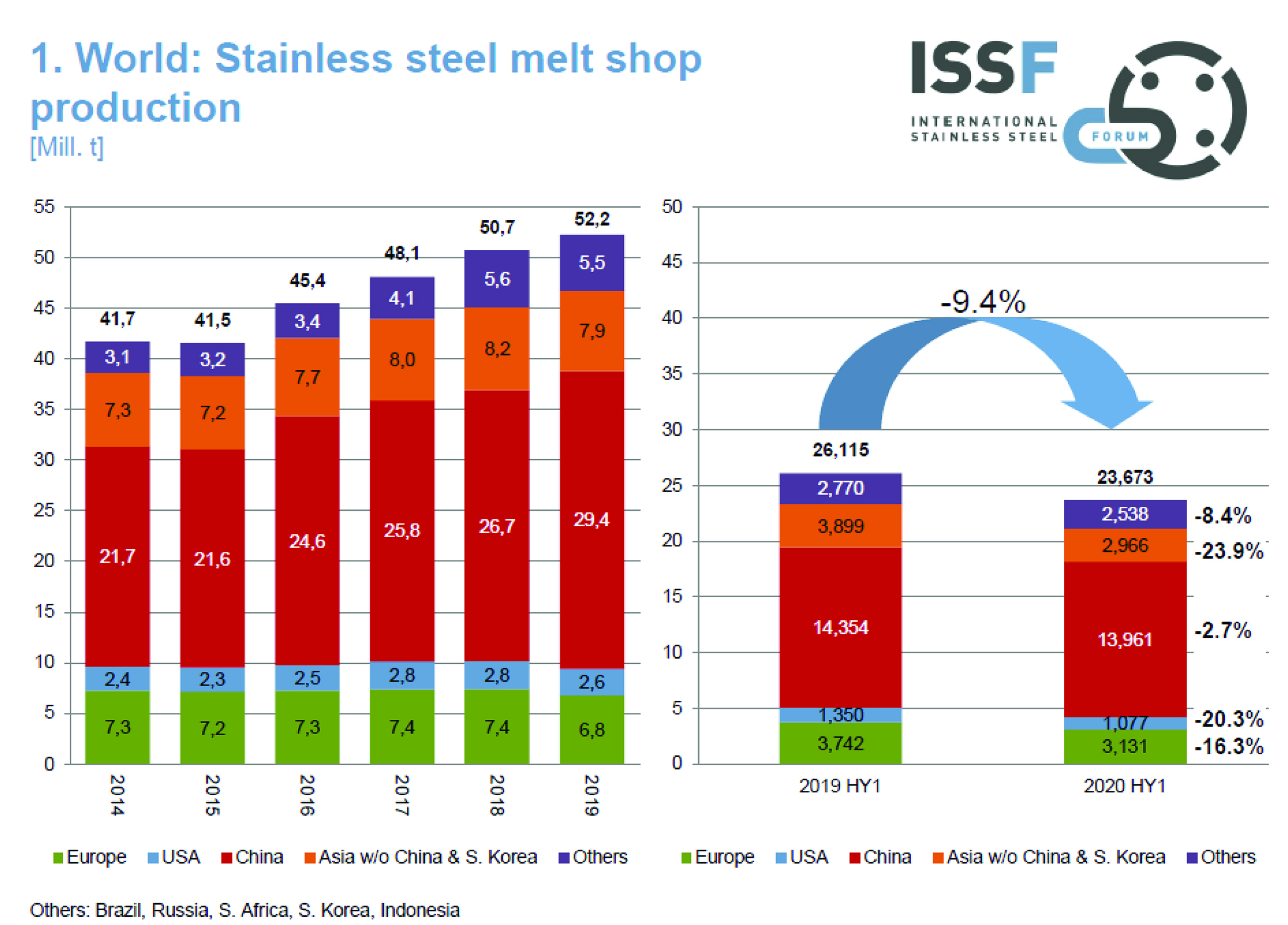

During its annual conference in October 2020, the ISSF released the following statistics on regional and global growth and consumption of stainless steel. Figure 1 indicates that since 2015, global melt shop production of stainless steel has shown a steady increase until 2019 when global production reached 52.2-million tonnes of stainless steel. It is believed that 2020 will see a decline in melt shop production of just less than 10%.

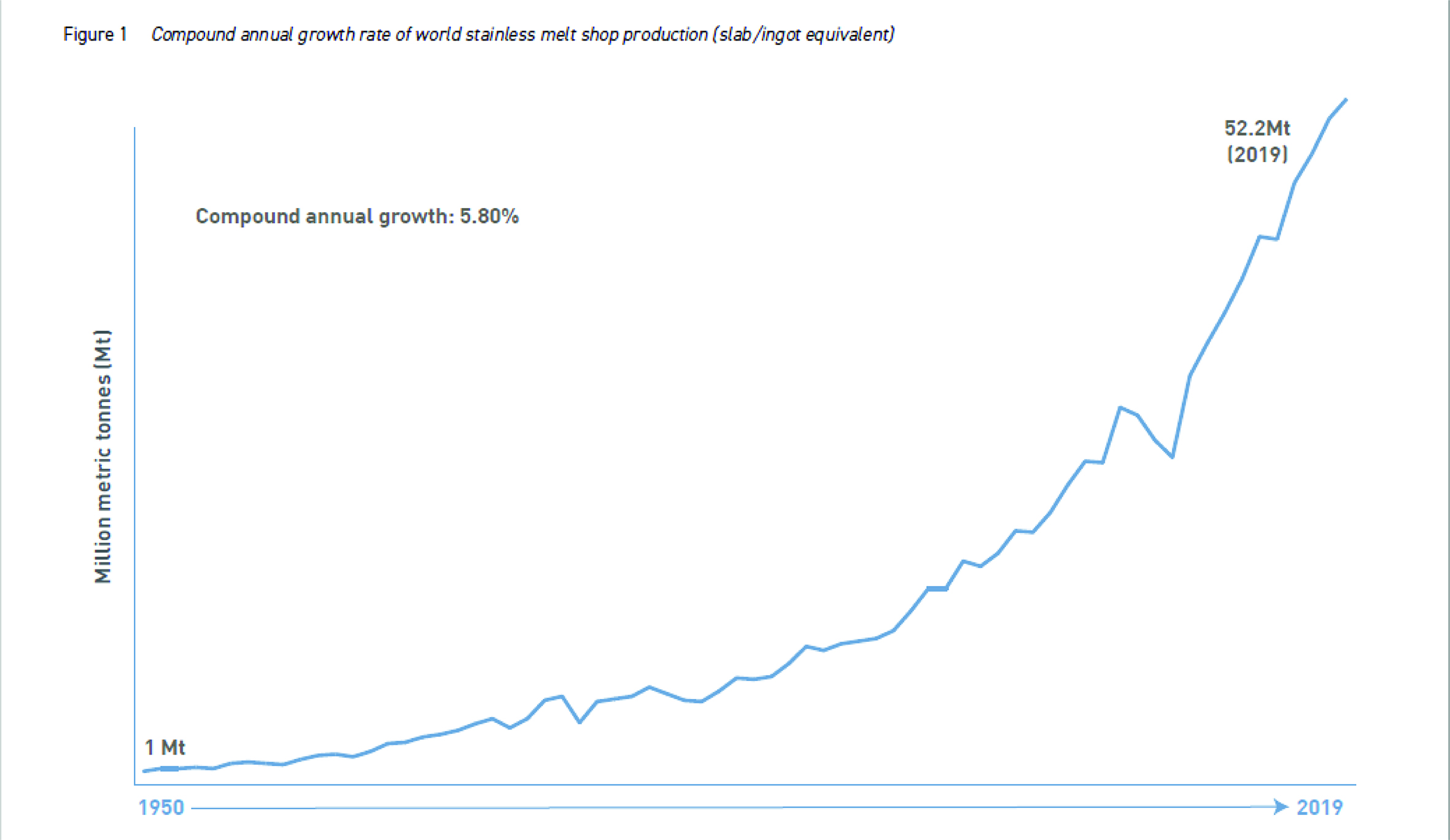

The historic growth rate of stainless steel consumption is indicated in figure 2 and stands at a compounded rate of 5,8%. The same graph shows the growth of plastics. A decade or two ago, plastics were regarded as major competitors. The advent of new grades and applications shows a remarkable breakaway by stainless steel.

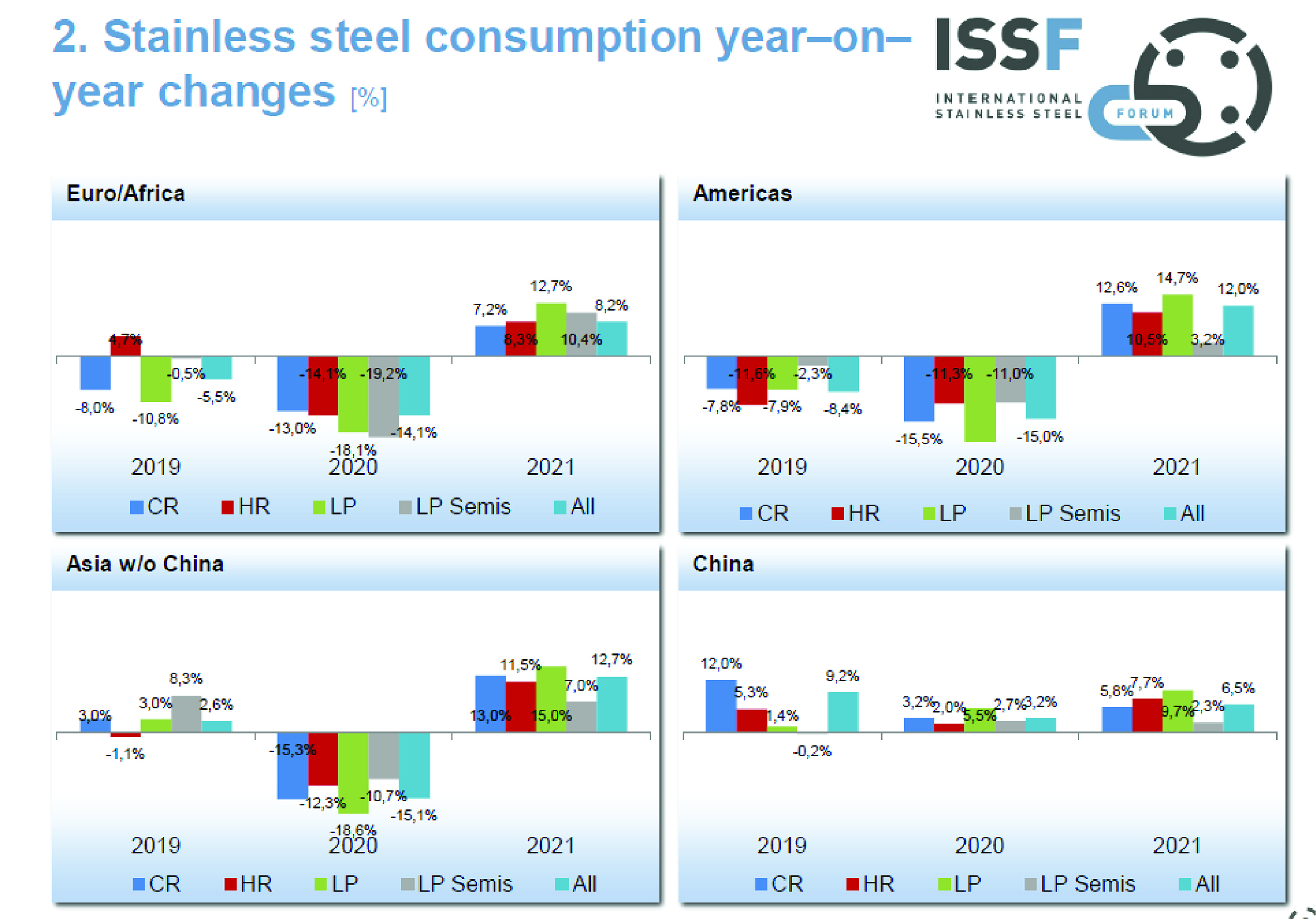

What might be of more practical value is the current global outlook and what the ISSF forecasts for stainless steel. Figure 3 shows the stainless steel consumption for the various global regions. Consumption in China is low, but positive, compared to negative growth for the rest of the regions during 2020. The apparent consumption in Europe and Africa is predicted to have a negative growth rate of between 13% to 119% on the variety of material products. This seems in line with Sassda statistics on the apparent local consumption. Asia, excluding China, is showing similar performance as Europe and Africa, while similar conditions currently prevail in both North and South America.

The expected recovery in 2021 is not regarded as drastic for China, with an expected increase in consumption of between 6% and 10%. Both the North and South America continents are expected to see a remarkable 10% to 15% increase in consumption. Africa, as part of the European grouping in terms of steel making, receives a forecast of 7.2% as a general increase in the consumption of all products. This is encouraging and the local stainless steel sector might see local consumption growth in excess of GDP.

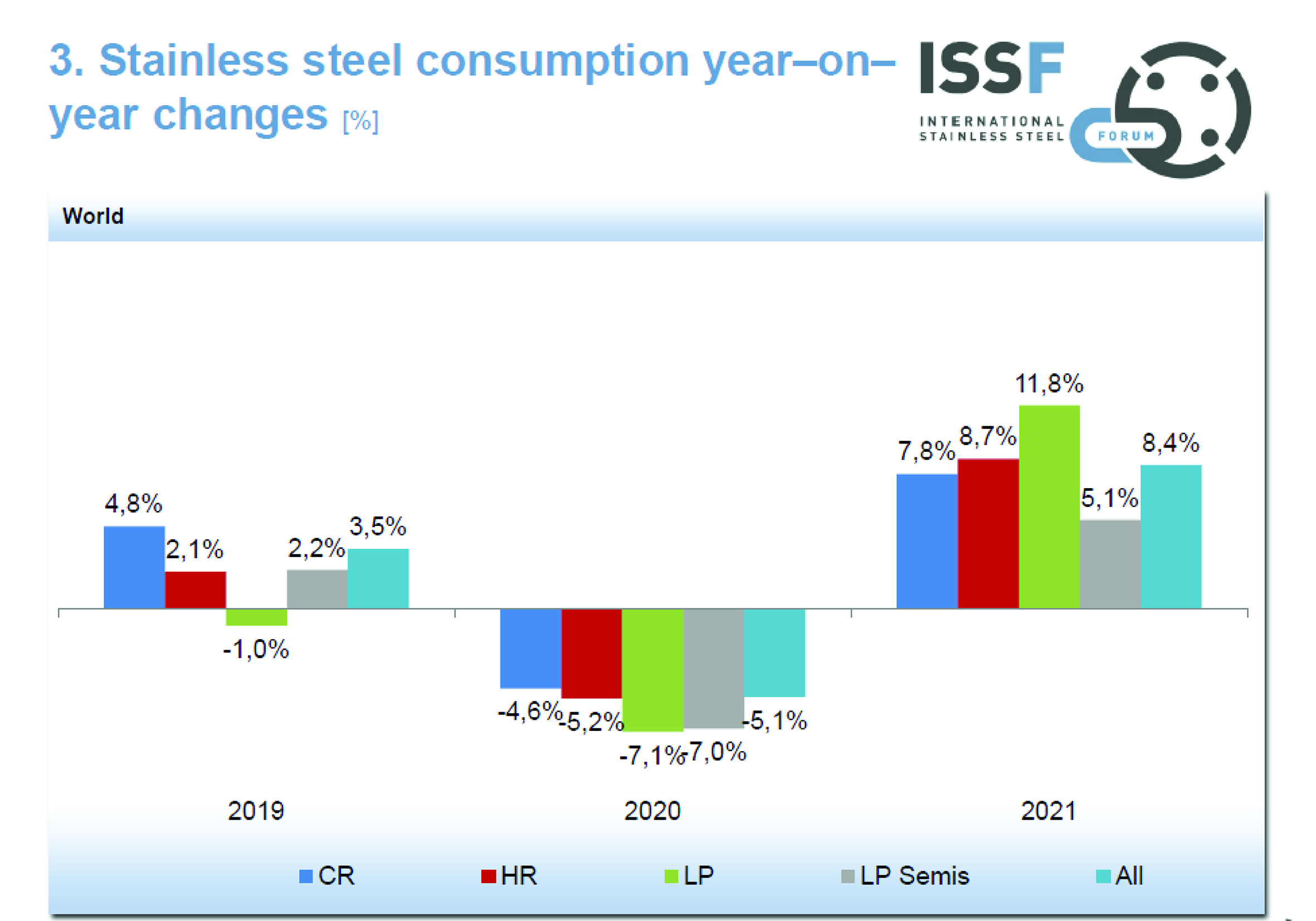

Figure 4 illustrates the global snapshot for cold-rolled (CR), hot-rolled (HR), long products (LP) and Semis. Seen against the historic rate of growth of 5.8%, 2019 did not quite live up to the general trend. From this reduced level of activity, the COVID-19 pandemic added to the dramatic decline in all production forms during 202, resulting in an average decline of 5.1%. South African statistics show the local decline was worse, in the order of 15 to 20% for 2020. The ISSF projection of 8.4% global growth in stainless steel consumptions is encouraging. The prediction for Africa as a region is shown as an expected 8.2% for all products.

In the times we live in, it is risky and even reckless to predict anything. However, international statistics indicate that 2021 might see a long-awaited turnaround locally; good news indeed for the South African stainless steel sector!