Amidst the flux of COVID-19 and other societal and economic upheavals we thought it would be helpful to undertake a more in-depth look at the South African stainless steel consumption figures. Here Acting Executive Director Michel Basson presents a longer-term view of Sassda’s renowned industry statistics…

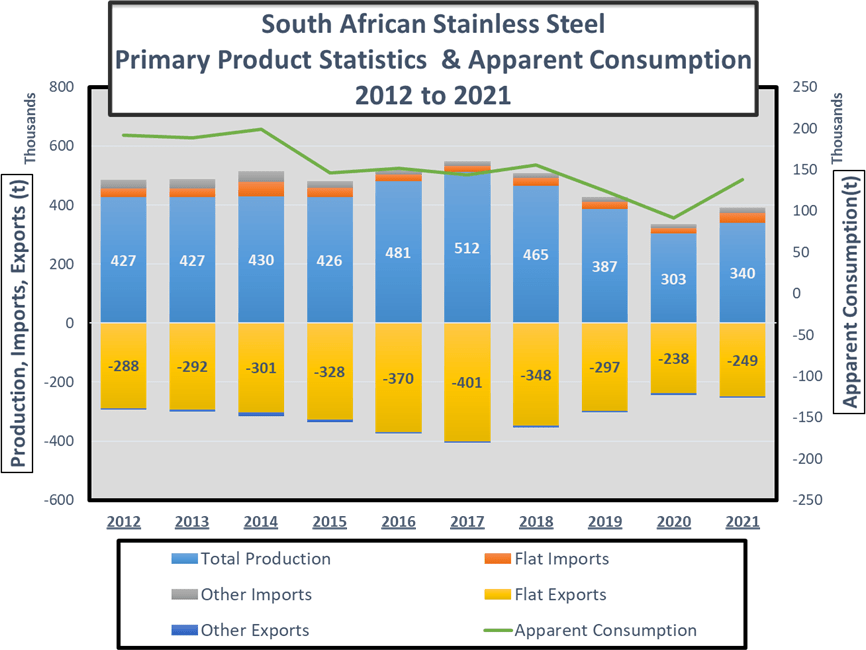

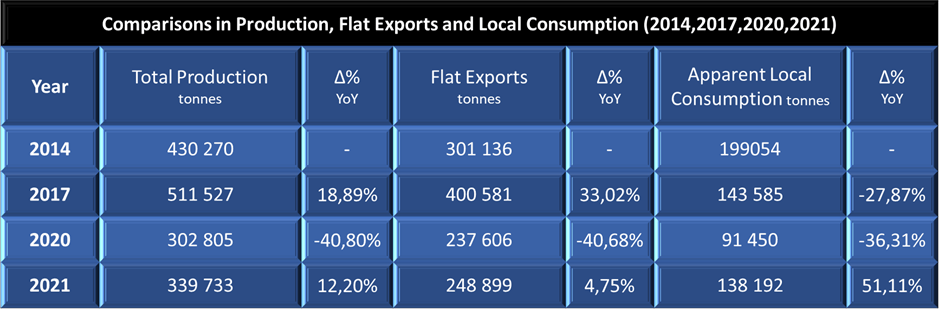

“The total local production with imported flat products and other stainless steel products is shown above the zero line is shown while the total exports of flat and other stainless steel materials are displayed under the zero line. The result is indicated by the green trendline with values to the right. This shows a decline in the local consumption of stainless steel over a decade. This shrinkage is roughly a quarter of the consumption in 2012. The period from 2012 to 2014 was stable at around 200 thousand tonnes of stainless steel consumed and converted within the national borders.

“The first drastic decline was seen in 2015. Keep in mind that in 2015 South Africa saw a number of social and political protests when the parliamentary system was disrupted and new xenophobic uprisings took place. The social protest Rhodes Must Fall started in 2015 and the education sector saw South Africa record a drop in its matric pass rate from 2013 to 2014. The protest #FeesMustFall was started towards the end of the year.

“This led to a four year-long period of social, political and economic instability causing a general slowdown in the South African economy. This is reflected by the apparent stainless steel consumption slumping to levels of around 150 thousand tonnes per year. During the first half of 2019, this instability escalated and the downward trend in consumption increased.

“In 2020, the impact of the COVID-19 pandemic saw consumption figures drop to their lowest level in the decade, at less than 100 thousand tonnes consumed locally. The recovery after the pandemic is apparent when analysing 2021 statistics, which reflect levels closing in on those recorded during the 2015 to 2018 period.

“Whether this positive momentum can be maintained during 2022 and beyond is uncertain. The current volatility of Nickel prices, fuel and energy concerns and a slowdown in the global economy makes the future unpredictable.”