- Perspective – July 2023

- Best of the GPS Newsletter

- Webinar Report Back

- State of the Nation

- Multi Alloys & EMV Africa

- Demand Drivers – SA Rail

- Fastenright Advert

- Africa Profile

- Technical Insight

- Grinding Techniques Advertorial

- Technical Insight

- Technical Insight

- Pferd SA Advert

- Passionate Professional Profile

- Obituary – John Cluett

- Staff News

- PtSA Member Visit

- Steel Summit

- KZN Golf Day 2023

- Columbus Mill Visit

STATE OF THE STAINLESS STEEL NATION

In his latest ‘view from the top’ Sassda Executive Director Michel Basson delves into the persistent issue of volatility within the various aspects of the South African economy. From fluctuating material prices and global supply disruptions to unpredictable local electricity supply, our State of the Stainless Steel Nation analysis examines how these uncertainties are creating a uniquely challenging set of circumstances for local stainless steel players…

In his latest ‘view from the top’ Sassda Executive Director Michel Basson delves into the persistent issue of volatility within the various aspects of the South African economy. From fluctuating material prices and global supply disruptions to unpredictable local electricity supply, our State of the Stainless Steel Nation analysis examines how these uncertainties are creating a uniquely challenging set of circumstances for local stainless steel players…

1.How would you categorise the performance of the South African stainless steel sector in the last year? What is the state of the market at present?

As reported earlier this year, there was an unexpected increase in the use of stainless steel in 2021, locally as well as globally. We ascribe this to two influences. Keeping in mind that stainless steel is used in applications where cleanability, hygiene, and corrosion protection are required, many projects that were put on hold during the pandemic had to go ahead in 2021 as a matter of urgency.

As such, the increased use of stainless steel can be seen as the completion of many projects on temporary hold. On the other hand, many distributors started to replenish stock items as the expectations of market activity increased in 2021. It, therefore, did not come as a huge surprise when there was a lower demand for stainless steel in 2022 across the globe. The geographic markets of Europe and Africa saw a decrease in growth from a spectacular 18% in 2021 to a growth of less than 2% in 2022.

In a sense, it was a period of consolidation, and the use of stainless steel was further dampened due to the spike in nickel prices in Quarter 2 of 2022. The uncertainty around electricity supply reached unknown levels in the latter part of the year with a serious impact on the manufacturing capacity of our members. This meant that any stainless steel that moved in the local value chain, moved at a snail’s pace.

2.Please can you give some other meaningful stats relating to how the industry has performed?

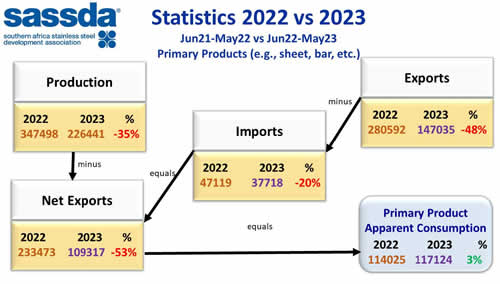

The infographic above shows some of the statistics that Sassda gathers and processes. In this case, we compare the apparent local consumption in the period June 2021 to May 2022 to the reported consumption for the 12 months from June 2022 to May 2023.

The upper right block indicates the change in local production which has reduced by 35%. It should be understood that the local use of stainless steel flat products is small in comparison with the total capacity of the mill, meaning that most of the production is intended for the export market. The limitations on the volumes that can be exported to Europe are showing their impact when the

upper left block is studied where exports declined by 48%.

Imports also slowed for various reasons, including the requirement for 100% local content on infrastructure programmes, as well as the exchange rate. This means that nett exports (exports minus imports) also reduced by 53%. Should nett exports be subtracted from the total production the answer yields the apparent local consumption for the period being investigated.

From this graphic, it can be deduced that the apparent local consumption of stainless steel has increased when compared to the previous 12 months. This is very encouraging although it may be a bit early to start any celebrations.

The Reserve Bank showed that after contracting by a revised 1,1% in the fourth quarter of 2022, real gross domestic product (GDP) edged higher in the first quarter of 2023 (January - March), expanding by an estimated 0,4%.

The Sassda infographic indicates an apparent growth rate that far exceeds the country’s GDP growth and this is regarded as a strong positive indicator for our industry.

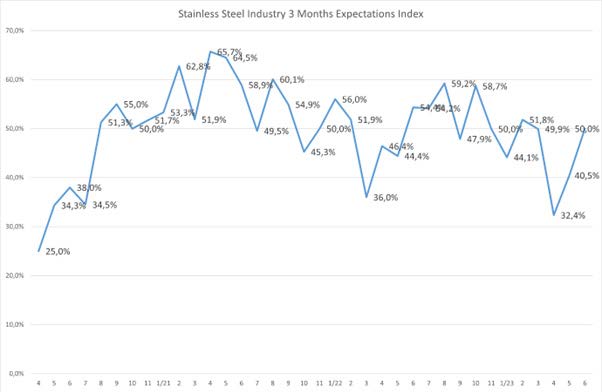

Sassda members are also more positive albeit that our 3-month forecast based on member confidence still remains below or at 50%. This is illustrated by our monthly measurement of member confidence below.

Members were fairly confident during the winter of 2022, but this confidence started to taper off in the last quarter which can be mainly attributed to the levels of load shedding during that period combined with the uncertainty regarding the future state of electricity supply.

The new year started with an index of more than 50%, but the effects of Eskom’s continued woes, the sudden slump in the exchange rate and increased interest rates pushed confidence levels down to 32%, which is lower than even during the dark days of the pandemic. It is therefore encouraging to see that members have once again increased confidence in the future of our industry. We hope this trend will continue.

3. The South African stainless steel sector is currently under review from various quarters namely the: i. Steel Master Plan and the ii. Competition Commission’s Steel Industry Review. What is Sassda’s role in each of these and what is the current status of each?

Sassda has been part of the Steel Master Plan since its inception. Sassda officially forms part of the Local Demand Committee and has submitted initiatives on the localisation of beer kegs, cutlery, and hollowware. These initiatives are active and currently in process with a good prospects for success. It is important to note that the stainless steel sector is a small component of the overall South African steel industry. It can therefore be said, with some pride, that our sector is punching above its weight in the Steel Master Plan rollout.

This should also be considered when the results of the current Competition Commission review into the steel industry are published. In 2014, the South African steel industry was ranked 19th in terms of global crude steel production and was the largest producer on the African continent, producing more than half of the continent’s steel output. In 2021, South Africa was ranked as the 32nd largest crude steel producer in the world, with an output of 5 Mt. This indicates that South Africa’s competitiveness in the production and supply of steel has been declining.

The Steel Industry Inquiry was established in terms of Chapter 4A of the Competition Act No. 89 of 1998 and will examine whether or not there are any features or a combination of features in its value chain that impede, distort, or restrict competition in the South African steel industry.

It is also worth noting that a “market inquiry” is a general investigation into the state, nature, and form of competition in a market, rather than an investigation of specific conduct by any particular firm. Sassda and its members adhere to a strict code of conduct regarding competitive behaviour, and it would be a surprise should the findings of the commission implicate serious

anti-competitive behaviour in the stainless steel sector.

4. What are the biggest challenges facing the local stainless steel sector in the next 12 months, both global and local?

Volatility remains one of our biggest challenges. Whether that is the volatility in material prices, in global supply and logistics, or volatile local uncertainty in electricity supply.

The volatility in our environment causes instability in the value chain and this impacts heavily on the effectiveness of the value chain. There is not much Sassda and the local industry can do to influence global stainless steel supply, logistics, and prices. There is also not much that the South African stainless steel sector can do to improve the current issues in Europe that are placing a damper on exports to Europe.

With exchange rate against any importation of stainless steel products, it can be an opportune time to fast track localisation and stimulate local demand for locally made products. We support and try to facilitate our members’ efforts to diversify, increase productivity, and the innovative use of the capacities and skills available to the South African industry. In short, Sassda and its members understand very well that evolving and constant organisational change remains key to the survival of the industry sector.

5. What are the key global and local sectors that have the greatest potential to drive demand for South African stainless steel and what role does the renewed interest in the concept of localisation by government have to play in this regard?

Localisation is the key ingredient when the future growth of the stainless steel industry is discussed. However, it is important to understand what Sassda means with the term “localisation”. In this context, localisation means that previously imported products will be replaced with similar or better products that are locally made competitively and sustainably.

Sassda believes that competitive and sustainable localisation will lead to economic growth, improved value chain performance, and the creation of meaningful jobs. It can also be instrumental in breaking the chain of poverty that holds nearly half of our population captive.

A well developed local supply chain of specific stainless steel products can be extended to the export market and will be able to compete globally in terms of price and quality. It has also been identified that the biggest potential export market would be the one closest to our country, Africa. South Africa has expertise in many areas that have lucrative market potential in Africa.

Healthcare and medical equipment, water treatment and storage, agricultural and agri-processing equipment, food and beverage, pharmaceutical, mining, as well as general processing plant and equipment jump to mind when thinking of sectors that can stimulate local and export demand.

Africa offers endless market potential, but it remains imperative that a strong and competitive industry be built on the back of intensive localisation. It is also foreseen that a strong and vibrant industry will stem the outflow of intellectual property, skills, and capacity from South Africa and offer opportunities to young professionals and entrepreneurs.

6. How has Sassda evolved against the backdrop of unprecedented local and global challenges that have faced, and continue to face, its members?

There was an evolution in the way that Sassda does things even before the pandemic forced change on industry and the community. It remains critical for Sassda to be accessible to members, the industry, and our partners to create awareness and promote the use of stainless steel in South Africa. For example, we have made our products accessible by turning all the Sassda official training programmes into world-class products that can be accessed by anyone globally via our virtual classroom settings.

Most of our member meetings have been accessible online since 2019. This intervention allowed Sassda unparalleled access to industries and sectors we could not penetrate before. However, Sassda has also added new value in the way it intervenes on behalf of members when engaging with government. As an association our lobbying resulted in alleviating the industrial clampdown during COVID-19 by gaining permission to open up the stainless steel industry to a 50% level compared to the 30% allowed for other industries.

Another example would be when Sassda made submissions to the dtic regarding the ban on the exportation of scrap metals in 2022. The submission and communication with government resulted in the removal of stainless steel from the metals included in the Bill.

Sassda is constantly changing, and we try to keep ahead of the industry in terms of early adaption to circumstances to lead the way. Sassda is embarking on a drive to create more capacity within the association to be able to provide insight and services to members to facilitate change and in time adapt to new trends and potential markets.

7. What are some of the key projects/initiatives/ programmes that Sassda will continue to champion in 2023

Sassda cannot afford to be reactive to member and industry needs. The association has a strategic responsibility to lead and be the official and relevant mouthpiece of the local value chain. Sassda is currently in the process of upgrading all training manuals and presentations to reflect accurate and up-to-date information.

This process is also important as new technology such as laser welding is becoming more popular in our industry and needs to be included in our training products.

While we hope to keep on improving our products, services, and the delivery thereof, we will maintain our efforts to lobby the government on issues that impact our members and their future. It is important to mention that our lobbying process with government would never be negative. Our submissions contain statistics and data to support our view, but always remain flexible and open to alternatives towards a pragmatic solution. Sassda prefers to be a constructive partner towards a better South Africa.

The current localisation drives active in the Steel Market Plan are reaching critical milestones and will continue to receive our undivided focus. Sassda has been involved in getting stainless steel written into the national standards for roofing, cladding, and road safety equipment such as road barriers. We are embarking on a mission to get 3CR12 included in any future specifications for Eskom transmission towers as well as rural emergency bridges that are currently under discussion.

Michel Basson

Sassda Executive Director